| Year | Opening Balance (₹) | Deposit (₹) | Interest (₹) | Closing Balance (₹) |

|---|

A PPF calculator helps investors estimate the maturity amount, total investment, and interest earned over the tenure of the PPF account.

By using this calculator, individuals can plan their contributions better and align their investments with long-term financial goals.

Table of Contents

What Is Public Provident Fund (PPF)

A Public Provident Fund (PPF) is one of the most popular long-term investment options for individuals looking for safety, stable returns, and tax benefits.

The Public Provident Fund (PPF) interest rate is set by the Government of India and reviewed every quarter. The current interest rate is 7.1% per annum.

- Interest is compounded annually and credited at the end of the financial year.

- It applies whether your PPF account is with a bank or a post office.

- PPF maturity amount is tax-free.

Difference Between PPF And EPF

| Feature | PPF (Public Provident Fund) | EPF (Employees’ Provident Fund) |

|---|---|---|

| Who Can Invest | Any Indian resident (salaried or self-employed) | Salaried employees in eligible organizations |

| Nature of Scheme | Voluntary savings scheme | Mandatory for eligible employees |

| Contribution Limit | ₹500 to ₹1.5 lakh per year | Usually 12% of basic salary + DA |

| Employer Contribution | No | Yes (equal contribution by employer) |

| Interest Rate | Set by Government (currently around 7.1% p.a.) | Declared annually (currently around 8.25% p.a.) |

| Interest Calculation | Calculated yearly, compounded annually | Calculated monthly, credited yearly |

| Tax Benefits | EEE (Contribution, Interest, Maturity are tax-free) | EEE (subject to conditions) |

| Lock-in Period | 15 years | Till retirement or job exit |

| Partial Withdrawal | Allowed after 6 years (with conditions) | Allowed for specific purposes |

| Loan Facility | Available from 3rd to 6th year | Available under certain conditions |

| Risk Level | Very low (Government-backed) | Very low (Government-backed) |

| Best For | Long-term savings and tax planning | Retirement savings for salaried employees |

Note: You can check your EPF maturity amount by using our EPF calculator

What Is A PPF Calculator?

A PPF calculator is an online tool designed to calculate the expected returns on investments made in a Public Provident Fund account.

By entering details such as the annual contribution, investment tenure, and applicable interest rate, the calculator provides an estimate of the maturity value at the end of the PPF tenure.

How Does The PPF Calculator Work?

While the exact calculation involves annual compounding, a simplified formula often used for estimation is:

Maturity Amount = P × [(1 + r)ⁿ − 1] / rWhere:

- P = Annual contribution

- r = Annual interest rate (in decimal)

- n = Number of years of investment

A PPF calculator uses this logic internally to generate accurate results.

Example of PPF Calculation

Assume an individual invests ₹1,50,000 every year in a PPF account for 15 years at an interest rate of 7.1% per annum.

- Annual investment: ₹1,50,000

- Total investment over 15 years: ₹22,50,000

Using a PPF calculator, the maturity amount would be approximately ₹40 lakh, and the interest earned would be around ₹17.5 lakh. This demonstrates the significant impact of long-term compounding.

How To Use The PPF Calculator?

To use the PPF calculator, you just need to enter the investment amount and tenure, and the calculator will show you the maturity amount and amortization schedule.

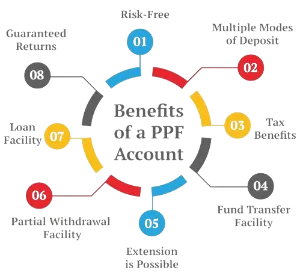

Benefits Of Using The PPF Calculator

- Accurate Estimation of Maturity Amount

- Helps in Long-Term Financial Planning

- Saves Time and Effort

- Helps Track the Power of Compounding

- Assists in Tax Planning

- Encourages Disciplined Savings

- Useful for Comparison with Other Investments

Conclusion

A PPF calculator is an indispensable tool for anyone investing in a Public Provident Fund. It ensures accuracy, transparency, and smarter financial planning.

Whether you are a salaried professional, self-employed, or a first-time investor, using a PPF calculator helps you visualize the growth of your savings and make informed decisions.